股权投资澳门皇冠赌场平台

股权澳门皇冠赌场平台优先事项

每年, CHS董事会决定赎回并分配给业主的现金赞助和股权的数量. Those decisions are based on three key criteria:

CHS退还了3美元.在过去的10年里向业主支付了20亿美元

挑战

通过与税务部门协商, 法律和资本结构专家, the CHS Board identified three significant challenges with the CHS equity management program:

挑战1

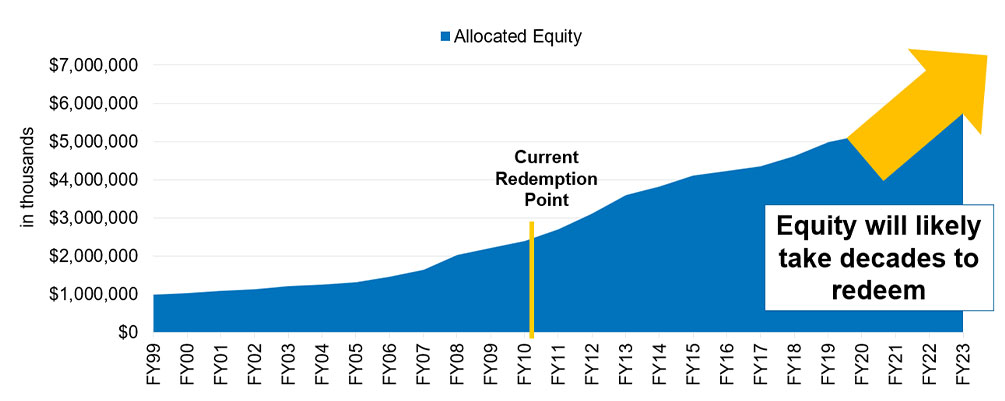

CHS has been issuing equity faster than it can redeem equity.

With no change, allocated equity volume would continue to increase and

会增加几年的赎回时间吗

Regardless of earnings, equity issued has exceeded equity redeemed

挑战2

The CHS Board has had too few tools available to make effective annual equity decision; more flexibility is needed.

挑战3

Preferred stock dividend treatment has resulted in issuance of increased equity.

在过去的15年里, the volume of allocated equity has tripled – and it’s more than five times the equity held in 1999. 分配股权每年都在增长, even during times when CHS had strong earnings and returned a significant amount of cash to CHS owners.

继续以这种方式澳门皇冠赌场平台股权可能意味着,随着时间的推移,CHS股权计划对所有者的价值将会降低, since it would likely take decades longer to redeem equity.

Solution approved by CHS members at the 2023 CHS Annual Meeting

Amend CHS Bylaws to allow equity holdback from 0% to 35%

- Give CHS Board flexibility to make equity decisions based on market conditions

- This will not change the amount of cash generated by CHS

Amend CHS Bylaws to allow reduction of earnings by preferred stock dividends when calculating patronage

- Treat preferred stock dividends similar to interest

- This will not change the amount of cash generated by CHS

常见问题

-

Does a change in the holdback percentage affect available cash?

No, a change to the allowable holdback percentage will not impact the amount of cash available. 每年, CHS has three important areas to use its cash:

- Repairs and maintenance, since we must keep our assets in good condition

- Reinvesting in the business for future generations

- Determining how much cash to return to the country through cash patronage and equity redemptions, with the intention of returning as much as possible.

改变持股比例不会影响CHS董事会决定返还给业主的金额, since that amount is based on the cash available, 这不会改变.

-

为什么我们不能通过自己的努力摆脱这个挑战呢?

Higher earnings lead to more equity being issued, which compounds the current situation. 例如, 2022财年和2023财年的收益创历史新高,我们宣布给股东的回报分别为10亿美元和7.3亿美元, 分别, and yet net allocated owner equity still grew both years.

CHS无法通过赚钱来解决这个问题. 我们的业务是资本密集型的, 由于持续的重大维护资本支出需要维护我们的资产和基础设施, plus necessary growth investments to ensure we stay competitive and relevant for our members. Therefore, higher earnings do not always translate into more cash available.

-

Why not only change how preferred stock dividends are treated and leave holdback as is?仅仅改变优先股股息的处理方式,不会对解决CHS发行已分配股票的速度快于赎回这些股票的速度这一挑战产生重大影响. Without also increasing the maximum allowable holdback, the timeline for redeeming CHS equity in the future will likely become substantially longer, making the equity program less valuable to owners over time.

-

你是怎么把犹豫率降到零到35%的?

CHS consulted with tax, financial and capital structure experts to evaluate the program. Tax and accounting experts advised us to limit the maximum holdback percentage to below 50%. 我们考虑了很多场景, 包括一系列的保留百分比, and looked at the effect on allocated equity volumes, 以CHS自1999财年以来的盈利历史为例,说明我们以市场为导向的业务可能出现的业绩范围.

我们还进行了基准研究,以了解其他合作社如何处理分配的股权及其股权计划的其他方面. 根据这项研究, 很明显,目前CHS股权计划的有限灵活性已经过时,而且极不寻常.

The Board initially proposed a holdback of zero to 45%, 但他认为,零至35%的阻力有助于解决这一挑战,同时平衡从CHS所有者那里收到的各种投入. Based on owner feedback, the Board believes this level of flexibility will be supported. -

如果不采取行动会发生什么?

如果CHS成员没有采取任何行动, 未来赎回CHS股权的时间可能会大大超过目前的15年,最终可能会增长到几十年. 除了, 而股本总额将保持不变, inflation could erode its value over longer redemption periods. CHS might also be less attractive to capital and liquidity providers over time, limiting the company’s ability to grow and serve owners.

CHS希望维持一个有价值和可持续的股权澳门皇冠赌场平台计划,以确保当前和未来股权的价值. 我们正在努力平衡业主当前和未来的需求,并为子孙后代保持合作社的强大.

有用的定义

- 股权分配: equity that has been issued and assigned to a specific owner through patronage.

- 股本救赎: 赎回先前发行的已分配股权, usually with cash (also called retirement in the CHS Bylaws)

- 未分配的公平: owner equity that has not been issued to a specific owner. Unallocated equity, reported on the CHS balance sheet as the capital reserve, may include:

- Annual net income attributable to nonpatronage business.

- 根据现行CHS章程,每年不超过赞助业务年度可分配净收入的10%. (请注意:CHS业主在2023年CHS年会上批准的章程修正案将调整这一数字,使其不超过赞助业务年度可分配净收入的35%. The change will be effective at the start of fiscal year 2025 on Sept. 1, 2024.)

- Annual net income from patrons that does not meet a minimum amount of business.

前瞻性陈述: 本文件和其他CHS Inc .. 可公开获取的文件包括, 及卫生服务主任, directors and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate,”“意愿,”“计划,“”的目标,”“找,”“相信,”“项目,”“估计,”“希望,”“战略,”“未来,”“可能,”“可能,”“应该," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. 而不是, 它们只是基于CHS当前的信念, expectations and assumptions regarding the future of its businesses, 财务状况和经营成果, 未来的计划和策略, 预测, 预期的事件和趋势, 经济和其他未来状况. Because forward-looking statements relate to the future, 它们受制于固有的不确定性, 难以预测的风险和环境变化,其中许多不在卫生服务中心的控制范围之内. CHS的实际结果和财务状况可能与前瞻性陈述中所示的有重大差异. Therefore, you should not place undue reliance on any of these forward-looking statements. 可能导致CHS实际结果和财务状况与前瞻性陈述中显示的重大差异的重要因素在CHS提交给美国的文件中进行了讨论或确定.S. 美国证券交易委员会, 包括在截至8月31日的财政年度CHS年度报告10-K表格第1A项的“风险因素”讨论中, 2023. These factors may include: changes in commodity prices; the impact of government policies, 授权, regulations and trade agreements; global and regional political, 经济, legal and other risks of doing business globally; the ongoing war between Russia and Ukraine; the escalation of conflict in the Middle East; the impact of inflation; the impact of epidemics, 大流行, outbreaks of disease and other adverse public health developments, including COVID-19; the impact of market acceptance of alternatives to refined petroleum products; consolidation among our suppliers and customers; nonperformance by contractual counterparties; changes in federal income tax laws or our tax status; the impact of compliance or noncompliance with applicable laws and regulations; the impact of any governmental investigations; the impact of environmental liabilities and litigation; actual or perceived quality, safety or health risks associated with our products; the impact of seasonality; the effectiveness of our risk management strategies; business interruptions, casualty losses and supply chain issues; the impact of workforce factors; our funding needs and financing sources; financial institutions’ and other capital sources’ policies concerning energy-related businesses; technological improvements that decrease the demand for our agronomy and energy products; our ability to complete, 整合并从收购中获益, 战略联盟, 合资企业, divestitures and other nonordinary course-of-business events; security breaches or other disruptions to our information technology systems or assets; the impact of our environmental, 社会和治理实践, including failures or delays in achieving our strategies or expectations related to climate change or other environmental matters; the impairment of long-lived assets; the impact of bank failures; and other factors affecting our businesses generally. CHS在本文件中所作的任何前瞻性陈述仅基于CHS目前可获得的信息,且仅在陈述当日有效. CHS undertakes no obligation to update any forward-looking statement, 无论是书面的还是口头的, 这可能会不时发生, 是否是新信息的结果, future developments or otherwise except as required by applicable law.